Several travel-related news items flashed on my laptop screen late last month, reminding me of the power of well-known brands, cross-selling, proprietary customer databases, media clout and destination content.

Sam’s Club, a sister company of Wal-Mart and the eighth-largest retailer in the US, announced on June 24 the creation of Sam’s Club Travel, a new online travel service and collaboration with Tourico Holidays.

A few days earlier, Royal Caribbean Cruises Ltd. (RCCL), the second-largest cruise company in the world with a 23% market share, had confirmed that it was developing a new land tour operation to be called TourTrek.

These announcements followed several others that caught my eye earlier this year. In March, The New York Times launched an expanded tour operation as part of its Times Journeys travel subsidiary.

And, finally, Adventures by Disney, a division of the Walt Disney Company that started in 2005 with tours only to Hawaii and Wyoming but is now offering nearly 40 escorted programs worldwide, said in May that it was unveiling a variety of new adventures, some close to home but others further afield.

For the purposes of this blog post, cross-selling is the common denominator linking these four brands and their new ventures. And while there is inevitably some overlap in the market segments they are targeting, there are clear differences, too. Some of these companies are clearly making a move toward “experiential travel,” what a recent report by Peak DMC and Skift calls “more immersive, local, authentic, adventurous and/or active travel.”

Let’s look at these developments a little closer...

Brand Expansion and Cross-Selling

Sam’s Club has approximately 640 big-box-type stores, mostly in the US, that offer its members—47 million of them—a wide range of food and merchandise. For an annual fee of $45, members have access to what the company touts as wholesale prices. The retailer also has a massive online presence. Now, these members are automatically part of a travel club that offers “savings on 4,500 worldwide destinations, 90,000 hotels, more than 6,000 attractions in 800 cities, 150 airlines, 18 car rental brands and 13 cruise lines.”

Essentially, the club is a proprietary online information and booking site, developed and managed by travel wholesaler Tourico Holidays. Some of the exclusive features for both business and leisure travelers include 24/7 access, real-time price comparisons, integrated TripAdvisor reviews and “click to chat” services.

Hazarding a guess, many of these offerings appear to be what I call commodity travel products—airline seats, hotel rooms, popular resort properties and rental cars—and not the type of content-rich tour and small ship cruise programs that I’ve marketed most of my career.

Nevertheless, what I find amazing as a travel marketer is the ability of a dominant retail brand to tap into a totally different spending budget of its members, practically overnight. Sam’s Club is cross-selling, adding value to the membership and parlaying the trust and loyalty it’s built among those 47 million customers to generate additional income and protect that relationship.

It also used the recent travel club announcement to cross-sell another company product: the 5-3-1 Sam’s Club MasterCard. The credit card provides 3% cash back on travel and dining purchases, and apparently was the first offered by a US retailer with broad-based chip card technology. Let’s face it: chip-enabled credit cards are easier to use and more secure when traveling overseas. So, Sam’s Club will not only now sell you an airline seat, hotel room or resort stay online, but it’s happy to finance your travel purchases, too.

By partnering with Tourico Holidays, Sam’s Club is staking out a claim in the online travel booking space, and comes amidst some significant consolidation as big players like Priceline and Expedia shell out millions to acquire smaller booking sites, as reported last week in Skift. The fact that Sam’s Club’s major competitor Costco—the second-largest retailer in the US with 635 locations and 72 million members—started a travel club in 2000 was likely not lost on company management. Sam's Club had apparently made a previous effort at providing travel services to its members, but let that venture wither. You wonder what took the Walton clan so long to get back in the game.

Shore Excursions, But Without the Cruise Ship

While the cross-selling strategy for Royal Caribbean Cruises isn’t as dramatic as Sam’s Club—RCCL is in the travel business, after all—it does pose an interesting challenge for its cruise competitors as well as traditional land tour operators large and small.

And there is some logic and pragmatism behind the move. Through its Azamara Club Cruises brand, the company has forged ahead of many other big-ship cruise companies in recent years by offering more substantive, destination-focused cruising, less-frequented but deserving ports, and unique shore excursions. (Small cruise ship operators have been doing this for decades.)

Clearly, the company wants to stay on this path with the TourTrek announcement and to simply leave its 43 ships out of the equation. But tapping into the company’s database of hundreds of thousands of cruise customers and prospects—and that includes those of Azamara and Celebrity Cruises, too—will be the key to TourTrek’s initial success.

Company executives Larry Pimentel and John Weis see a huge opportunity to cross-sell to their Azamara, Celebrity and RCCL clientele, passengers who are hungry for a destination experience and who don’t always want or need the cocoon of a cruise ship when they travel. But these travelers do like the organization inherent in escorted tours and, based on their prior onboard experience, probably know that RCCL will do a good job in this department.

TourTrek will operate in 90 countries and has been described by the company as a “technology company.” This leads me to believe that online information and booking of tour programs will be front and center with the new venture. We’ll watch with interest as the new RCCL subsidiary takes shape, and whether its tour packages will be as logistically complex as those offered by traditional land tour operators like Abercrombie & Kent, Tauck, Collette, Grand Circle and other dominant brands.

Media Clout and Destination Content

By introducing travel programs, both The New York Times and The Walt Disney Company are obviously cross-selling to their loyal followers as well, but they have something that Sam’s Club and RCCL don’t have. And that is media clout. Sam’s Club and RCCL can buy it, but the Times and Disney have it.

Started two years ago by The New York Times with an offering of cruises aboard large ships and featuring enhanced lecture programs, Times Journeys is now diversifying its trips under several “trip style” categories: Luxury Travel, Active Travel and Focus On. The latter one is intended to provide an in-depth experience into a particular subject or destination’s culture.

Not surprisingly, The New York Times won't operate these programs itself, but will subcontract the operational logistics to established, well-regarded travel brands like Abercrombie & Kent, Mountain Travel Sobek and Academic Travel Abroad. The Times’ role in the partnership is marketing-based, bringing to the table its customer database, expert commentators and award-winning reporters, along with its ability to generate content that readers and, presumably, travelers want.

Can I first say that marketing travel under the Times brand makes a lot more sense than the various overpriced gizmos, antiques, collectibles and sports memorabilia found on the The New York Times Store website? Maybe selling this stuff, along with its wine club, is profitable, but it strikes me as a little embarrassing. Seems like controlling stockholder and publisher Arthur Ochs Sulzberger Jr. and his team are grasping at straws to deal with the precipitous fall in weekday circulation—and attendant advertising revenue—of the newspaper itself, now below one million.

Cross-selling destination-rich travel programs to Times readers is a more natural progression for the company, in my opinion. It’s all about providing great content to the client, something that The New York Times has excelled at for decades. As the Times Journeys website says:

Even for the ‘usual’ destinations, the availability of local experts and Times-selected specialists assures that Times Journeys travelers are more immersed and informed than travelers on ordinary tours. With curated content from The Times providing history and context for the destinations … these journeys are uniquely designed to appeal to the most exacting travelers.

While circulation of its newspaper has declined, web visits to The New York Times have exploded in recent years, and the site is regularly ranked one of the top websites for unique visitors. The company uses its media resources to occasionally include Times Journeys inserts in its print editions and via easily found links on its website and popular news feeds to millions of smart phones, tablets and laptops.

Will the Times Journeys programs provide a more substantive, destination-rich experience than those offered by RCCL’s TourTrek or other specialty operators? The end user ultimately will determine this. But a new Times Journey—“The Israeli-Palestinian Conundrum”—gives you some idea how the exceptional international news coverage the Times is known for will become the marketing hook used to pull readers into this new venture.

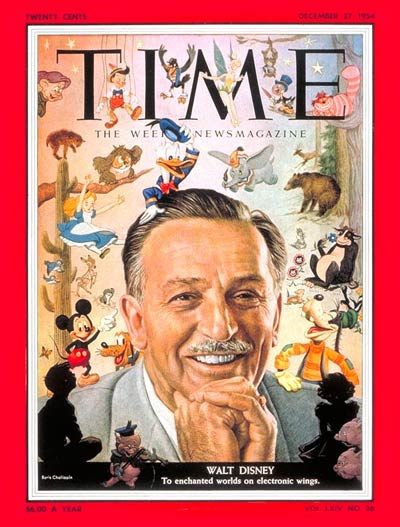

Walt Disney on cover of Time Magazine, August 1954. A masterful content provider who hooked us at an early age.

Adventures by Disney

People love the Disney brand, associating it with quality and imaginative content. And while many families might visit Disneyland or Disney World only once or twice in their lives—a near-$100 per person daily admission price sees to that—they trust that the brand will deliver the goods in the movies they watch, the toys they buy and the network or cable television programming they follow.

Beyond the parks, the company started cross selling into travel nearly 20 years ago when it launched Disney Cruise Line. While itineraries for its four ships now include Europe, Alaska and the Panama Canal, the experience aboard these vessels in still largely entertainment driven rather than destination driven.

And so, Adventures by Disney seemed a natural development for the world’s largest entertainment and media company ($45 billion in sales in 2013) when the new division was launched in 2005. After all, people grow up and look for new adventures beyond the imaginary ones found in the Disney parks, on TV or movie screens, or aboard fantasy-focused cruise ships.

It was inevitable that some Disney fans would want more substantive destination content. The company is now finally taking its customers to the exotic destination rather than pretending to bring the exotic destination to the customers via Epcot Center and the Disney theme parks. A broad range of one- to two-week tours can be found on the Adventures by Disney website: China and other Southeast Asia countries, South America, Europe and North America.

Several things in Adventure by Disney’s May expansion announcement caught my attention as a marketer. First, some of the long weekend tours (aka lower price point tours) that were recently rolled out feature exclusive visits to Disney-affiliated businesses or attractions. For example, the San Francisco program includes tours of company-owned LucasFilm Studios, which are not normally open to the public, and to the Silverado Winery, owned by members of the Disney family.

The long weekend in Manhattan includes a visit to the “Good Morning America” studio during a broadcast (Disney owns the show’s parent company, ABC), and a performance of Disney-produced “Aladdin” at the company’s New Amsterdam Theater, with a backstage visit.

While it’s not the sort of destination content that Times Journeys is selling, it is experiential destination content nonetheless, and the type that lifelong Disney fans will buy and take their families to enjoy.

Second, for the marketer, these adventures and their Disney-related features are a lesson in more than just cross-selling. Ever the master merchandiser, Disney is way beyond that. With these tours, the company is introducing other sub-brands and affiliated divisions, generating a constant whirl that reinforces and supports its myriad products and services, backwards, forwards and sideways. And, its huge media empire, including the ABC Network, is enlisted regularly to showcase its travel and entertainment products.

Just last week, Michelle Baran wrote in Travel Weekly that Disney’s animated film “Frozen” was creating a frenzy for travel to Norway. The highest-grossing animated movie of all time—bringing in close to $1.5 billion since its release in November 2013—spurred Adventures by Disney to roll out six departures of an eight-day Norway tour in 2014, and to add another six in 2015.

Photo of Disneyworld Jungle River Cruise courtesy Dr. Fumblefinger

Marketing That Jungle Fever

When I was a kid, the idea of going on the Jungle Cruise ride in Disney’s Adventureland was a pipe dream. How cool would that be? I had to satisfy myself by watching other families enjoy it on The Wonderful World of Disney, which was broadcast on Sunday nights in the late 50s and early 60s. (Disney was cross-selling even then. My parents bought me a coonskin cap so I could be like my hero, Fess Parker, star of the Davy Crockett series on the Disney program.)

So, I was particularly intrigued by the May announcement that Adventures by Disney was going to the Amazon River and Galapagos for the first time in 2015. Wow, the company was really going to do it: move beyond simulated riverboat cruises through a pretend jungle in Anaheim, California populated with Disney’s audio-animatronic jungle animals and guided by Disney cast members with a corny script. (Davy Crockett had his adventures on the river, too.)

This would be the real deal. Now you’re talking about real small-ship adventure travel, my specialty and something close to my heart. Several days aboard the comfortable 20-cabin Anakonda, canoe excursions to remote communities and in search of three-toed sloths or the reclusive pink river dolphin, And then, snorkeling in the Galapagos and cooking classes in Quito. There’s some destination content I could get my marketing chops into in a big way.

With its penultimate ability in cross-selling and media clout, not to mention its deft hand at tapping into our youthful fantasies, how can Disney miss with this one? The fan in me can’t help but wish them success in exposing the wonderful world of small ship adventure cruising to a segment of the traveling public that otherwise might never know about it.

Disney's idea of adventure had me hooked at an early age. Our ideas of what adventure travel really means have matured considerably over the past 50 years. Photoshop courtesy of Mark Babushkin Photography.